In his maiden budget, Finance Minister AHM Mustafa Kamal has proposed a set of measures to bring reforms to the ailing financial sector in the country.

In his maiden budget, Finance Minister AHM Mustafa Kamal has proposed a set of measures to bring reforms to the ailing financial sector in the country.

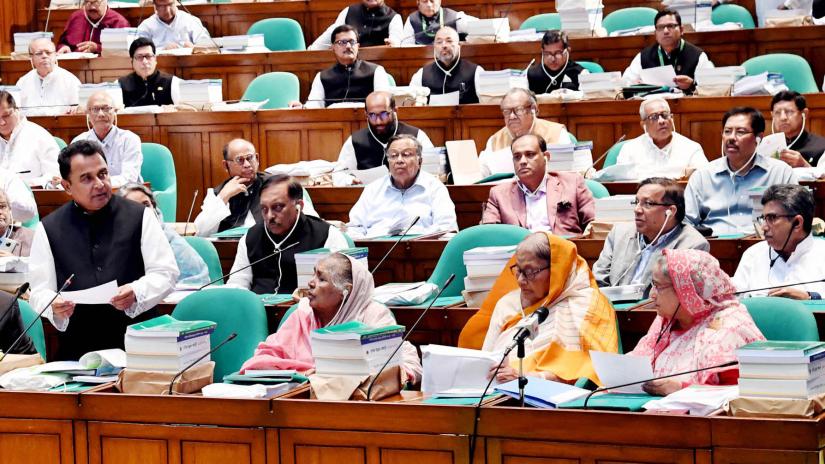

The proposals put forth in his budget speech presented in Parliament on Thursday (Jun 13), include increasing capital (authorised and paid up) of banks gradually, amending the Bank Company Act so that bank management, all components of revenue management (VAT, Customs and Income Tax) can function as usual, without facing any conflict with other laws.

The Bank Company Act will be amended so that amalgamation, merger and absorption of banks can be legally processed, if required, said Kamal.

"Stern measures will be taken against the wilful defaulters of bank loans," he said, adding that the government has been working to bring down the interest rates of bank loans to single digit to make industries and businesses more competitive.

He said necessary amendments will be brought to the Bank Company Act to modernise the functions of holding companies and subsidiary companies.

“We did not observe any mentionable reform initiative in some areas, especially in the banking sector, from the beginning. There was no exit route for the loan recipient if he/she fails to repay the bank loan,” read his budget speech.

According to finance minister, the government have arranged an exit for loan recipient through effective insolvency and bankruptcy laws.

“Establishing a Bank Commission for bringing discipline in the banking and financial sector has long been in discussion. We would discuss with all concerned in this matter and do the needful,” it reads.

He said the government has observed that no mentionable instruments were used in our financial sector.

This has led banks to give long term loans by collecting short term deposits, he said, adding that this creates a mismatch and turn out to be critical sometimes.

"We will take necessary measures to remove such kind of mismatch. We will encourage instruments like Wage Earners' Bond, venture capital, treasury bond including a vibrant bond market."

Business

Business

41076 hour(s) 1 minute(s) ago ;

Morning 06:55 ; Tuesday ; Jun 24, 2025

Kamal proposes reforms to ailing banking sector

Send

Bangla Tribune Desk

Published : 23:47, Jun 13, 2019 | Updated : 23:49, Jun 13, 2019

Published : 23:47, Jun 13, 2019 | Updated : 23:49, Jun 13, 2019

0 ...0 ...

/zmi/

Topics: Top Stories

- KOICA donates medical supplies to BSMMU

- 5 more flights to take back British nationals to London

- Covid19: Rajarbagh, Mohammadpur worst affected

- Momen joins UN solidarity song over COVID-19 combat

- Covid-19: OIC to hold special meeting

- WFP begins food distribution in Cox’s Bazar

- WFP begins food distribution in Cox’s Bazar

- 290 return home to Australia

- Third charter flight for US citizens to return home

- Dhaka proposes to postpone D8 Summit

Unauthorized use of news, image, information, etc published by Bangla Tribune is punishable by copyright law. Appropriate legal steps will be taken by the management against any person or body that infringes those laws.

Bangla Tribune is one of the most revered online newspapers in Bangladesh, due to its reputation of neutral coverage and incisive analysis.

F R Tower, 8/C Panthapath, Shukrabad, Dhaka-1207 | Phone: 58151324; 58151326, Fax: 58151329 | Mob: 01730794527, 01730794528