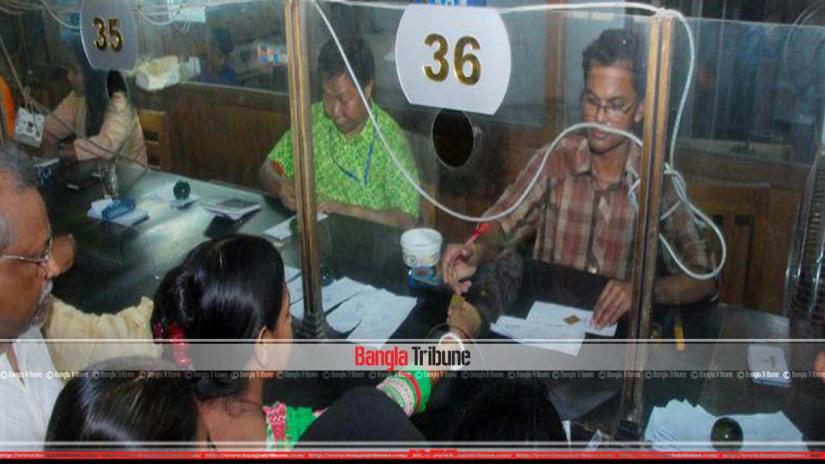

Private banks now face liquidity crisis. Bank MDs say: “Banking sector is passing through a precarious time; on one hand, deposit with low interest is not coming and on the other, loan recovery is low. Consequently, liquidity crisis is acute.”

Private banks now face liquidity crisis. Bank MDs say: “Banking sector is passing through a precarious time; on one hand, deposit with low interest is not coming and on the other, loan recovery is low. Consequently, liquidity crisis is acute.”

In such a state, the tendency to borrow from the market is rising which has seen the inter-bank interest rate rise to its highest level in the last five years.

After analyzing liquidity situation, it’s found that 10 to 12 banks have enough fund to invest, others are carrying out day to day operation by borrowing.

CEO of a commercial bank, says: “We are seeing the lowest loan growth in four years.”

Bangladesh Bank governor, Dr. Salehuddin Ahmed, says: “banking sector is passing through a crisis and moving towards a catastrophe. A few years ago, the sector was comparatively disciplined but the sector’s performance has faltered due to political interference and lack of accountability.”

Bangladesh Bank says that while deposit has risen by 10.58 percent in the last year, loan has soared by 12.98 per cent.

Since many banks are borrowing, the inter bank loan interest has risen to around 4.5 percent.

Reportedly, many banks are desperate for deposit and are willing to pay 10.50 percent interest if the deposit is high.

Executive director of Policy Research Institute, PRI, Dr. Ahsan H Mansur, says: “There has to be proper governance in the banking sector; with good governance all problems will be properly tackled.”

It’s found that Islami Bank, the biggest privately owned bank has reduced loans; once this bank used to bail out 10 15 banks and today it’s facing liquidity problems.

In 2017, loan disbursed by commercial banks and non-bank financial institutes was Tk over 2.02 trillion which came down to over Tk 1.88 trillion in 2018.

Chairman of Association of Bankers’ Bangladesh Syed Mahbubur Rahman, said: “The sector faced liquidity crisis all throughput 2018; consequently, many banks could not disburse loans as per demand. “

Business

Business

39733 hour(s) 10 minute(s) ago ;

Morning 08:04 ; Tuesday ; Apr 29, 2025

Most banks unable to disburse loans; liquidity crisis high

Send

Golam Mowla

Published : 07:30, May 13, 2019 | Updated : 07:30, May 13, 2019

Published : 07:30, May 13, 2019 | Updated : 07:30, May 13, 2019

0 ...0 ...

/tf/

Topics: Top Stories

- KOICA donates medical supplies to BSMMU

- 5 more flights to take back British nationals to London

- Covid19: Rajarbagh, Mohammadpur worst affected

- Momen joins UN solidarity song over COVID-19 combat

- Covid-19: OIC to hold special meeting

- WFP begins food distribution in Cox’s Bazar

- WFP begins food distribution in Cox’s Bazar

- 290 return home to Australia

- Third charter flight for US citizens to return home

- Dhaka proposes to postpone D8 Summit

Unauthorized use of news, image, information, etc published by Bangla Tribune is punishable by copyright law. Appropriate legal steps will be taken by the management against any person or body that infringes those laws.

Bangla Tribune is one of the most revered online newspapers in Bangladesh, due to its reputation of neutral coverage and incisive analysis.

F R Tower, 8/C Panthapath, Shukrabad, Dhaka-1207 | Phone: 58151324; 58151326, Fax: 58151329 | Mob: 01730794527, 01730794528