The amount of loan defaults in the country is increasing at an alarming rate with outstanding loan debts standing at Tk 110 billion every year.

An updated Bangladesh Bank report shows that in the last seven years the banks have faced loan defaults of over Tk 770 billion.

According to the central bank’s exposition, in 2011 the default amount was Tk 226.44 billion which has reached an astounding Tk 993.7 billion as of September of 2018.

Moreover, the banks have had to write off Tk 350 billion as bad debt and reschedule loan payments worth Tk 1000 billion. As a result the collective loan default in the banking sector currently stands at Tk 2500 billion.

“Loan defaults will keep on escalating as long as the bank administration does not improve,” said former Bangladesh Bank governor Dr Salehuddin Ahmed.

“It is due to the deficit in the administration that businessmen and bankers are embezzling money that belongs to the common public,” he added.

Speaking from experience, Salehuddin said that it is the business moguls who are prone to loan defaults and the banks keep on rescheduling their loans in order to decrease the loan default amount in the balance sheets.

According to the financial stability report of the central bank, in the last five years (2013-2017), the defaulters have been given the opportunity to reschedule loans worth over Tk 840 billion.

Bankers said that the banking institutions are under constant pressure from influential clientele to reschedule loans. In fact, it’s becoming increasingly difficult to collect outstanding debts from them, with some loans being rescheduled as many as 10 times.

Meanwhile, the banks are unable to collect loans worth Tk 1150 billion due to stay orders from higher courts.

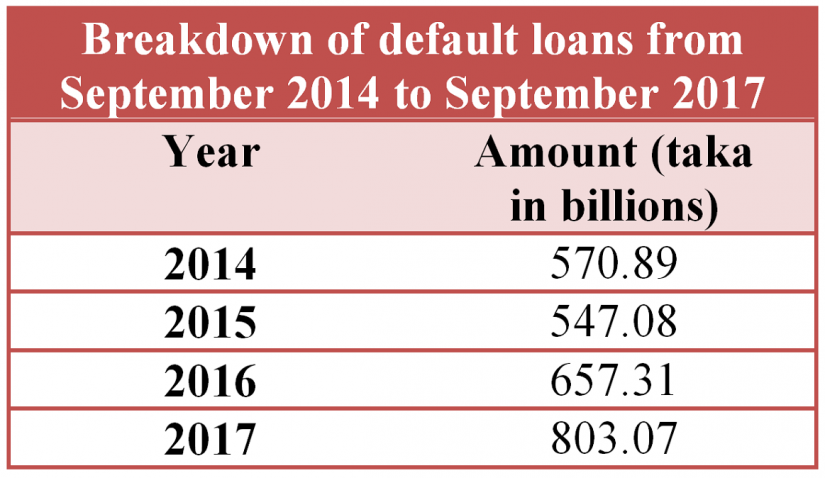

The report showed that in 2011 borrowers collectively defaulted on Tk 226.44 billion which increased to over Tk 427 billion in 2012. Meaning approximately 220 billion taka disappeared without any trace in the 2011-12.

In the year 2012, the banking sector lent an average of 17 billion taka in loans each month. Until September of that year the loan default amounted to over Tk 136 billion.

In the 2012-13 fiscal year the banks were cheated out of approximately 140 billion taka with an outstanding debt of almost 657 billion taka in 2013. Additionally, in the year 2017, a total of the banking sector lent an average amount of Tk 12.41 billion per month.

Additionally, in the year 2017, a total of the banking sector lent an average amount of Tk 12.41 billion per month.

“Even though the default amount is more at the end of September, it will decrease significantly by the end of December,” Bangladesh Bank spoke person Sirajul Islam told Bangla Tribune.

Islam added that the banks have been directed to collect the outstanding debts, as a result, the loan default amount will come down.

Business

Business

41269 hour(s) 9 minute(s) ago ;

Morning 08:03 ; Wednesday ; Jul 02, 2025

Loan default stands at Tk 110 million each year

Send

Golam Mowla

Published : 07:30, Dec 09, 2018 | Updated : 07:30, Dec 09, 2018

Published : 07:30, Dec 09, 2018 | Updated : 07:30, Dec 09, 2018

0 ...0 ...

/st/

Topics: Top Stories

- KOICA donates medical supplies to BSMMU

- 5 more flights to take back British nationals to London

- Covid19: Rajarbagh, Mohammadpur worst affected

- Momen joins UN solidarity song over COVID-19 combat

- Covid-19: OIC to hold special meeting

- WFP begins food distribution in Cox’s Bazar

- WFP begins food distribution in Cox’s Bazar

- 290 return home to Australia

- Third charter flight for US citizens to return home

- Dhaka proposes to postpone D8 Summit

Unauthorized use of news, image, information, etc published by Bangla Tribune is punishable by copyright law. Appropriate legal steps will be taken by the management against any person or body that infringes those laws.

Bangla Tribune is one of the most revered online newspapers in Bangladesh, due to its reputation of neutral coverage and incisive analysis.

F R Tower, 8/C Panthapath, Shukrabad, Dhaka-1207 | Phone: 58151324; 58151326, Fax: 58151329 | Mob: 01730794527, 01730794528