Apparel exports to non-traditional markets have posted a sharp growth of 21.77 percent to $5.68 billion in the just concluded fiscal year, with the clothing business to both traditional and non-traditional destinations hitting $34.13 billion during the period.

Apparel exports to non-traditional markets have posted a sharp growth of 21.77 percent to $5.68 billion in the just concluded fiscal year, with the clothing business to both traditional and non-traditional destinations hitting $34.13 billion during the period.

Nearly $5.70 billion came from non-traditional export markets and the rest $28.44 billion from traditional markets, mainly the USA and the Europe, say figures by the Export Promotion Bureau (EPB).

Woven products earned $2.79 billion, which was 22.91 percent higher than $2.27 billion fetched in the previous fiscal year. Knitwear raked $2.88 billion, up by 20.68 percent from a year ago.

Earnings from apparel items saw a 14.4 percent growth to $34.13 billion in the last fiscal year.

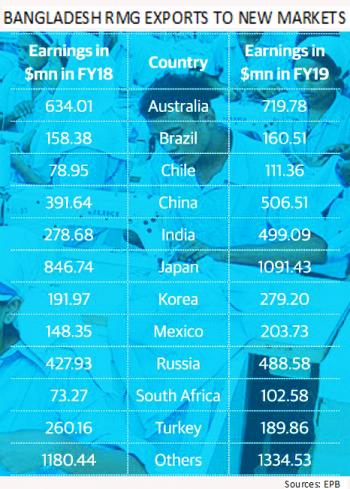

Australia, Brazil, Chile, China, India, Japan, Korea, Mexico, Russia, South Africa, and Turkey are considered as the major non-traditional export destinations for Bangladeshi products.

According to EPB statistics, Japan imported apparel goods worth $1.09 billion, which was nearly 29 percent higher from the previous year.

China, the second largest non-traditional market for the country’s RMG, imported products worth $506.51 million, up by 29.33 percent from the previous year.

In addition, exports to India rose by 79.09 percent to $499.09 million during the period, the highest growth of apparel registered in the just concluded fiscal year.  Only export to Turkey dropped by 27 percent to $190 million, which was $260 million a year earlier.

Only export to Turkey dropped by 27 percent to $190 million, which was $260 million a year earlier.

Businesses have attributed the cash incentive and initiatives to explore new markets to the sharp and continued rise in export earnings from the new destinations.

“Bangladesh’s export earnings from new markets are increasing faster due to market diversification initiatives from the government and the apparel manufacturers,” said former BGMEA senior vice president Faruque Hassan.

In the last couple of years, BGMEA in collaboration with the government created opportunities for the manufacturers to participate in the global expositions to connect new buyers, which contributed a lot to enhanced exports to new markets, adds Hassan, the managing director of Giant Group.

Besides, safety improvement in the apparel sector expedited the export growth as it boosted investors’ confidence, leading to more work orders, say industry insiders.

As a part of the government’s market diversification step, the government increased cash incentive from 3 percent to 4 percent for the last fiscal year, which encouraged exporters to go for new destinations, says former commerce minister Tofail Ahmed.

Currently, apparel exporters enjoy 4 percent cash incentive for exports to non-traditional markets, while 1 percent incentive for traditional markets for the current fiscal year.

Economists also think incentive played an important role in the sharp growth.

Cash incentive for non-traditional export markets yielded good result for apparel business, which needs to be continued, Centre for Policy Dialogue (CPD) research director Khondaker Golam Moazzem says.

Business

Business

41260 hour(s) 29 minute(s) ago ;

Evening 11:23 ; Tuesday ; Jul 01, 2025

RMG exports to non-traditional markets grow by 22%

Send

Ibrahim Hossain

Published : 06:00, Jul 15, 2019 | Updated : 06:00, Jul 15, 2019

Published : 06:00, Jul 15, 2019 | Updated : 06:00, Jul 15, 2019

0 ...0 ...

/hb/

Topics: Top Stories

- KOICA donates medical supplies to BSMMU

- 5 more flights to take back British nationals to London

- Covid19: Rajarbagh, Mohammadpur worst affected

- Momen joins UN solidarity song over COVID-19 combat

- Covid-19: OIC to hold special meeting

- WFP begins food distribution in Cox’s Bazar

- WFP begins food distribution in Cox’s Bazar

- 290 return home to Australia

- Third charter flight for US citizens to return home

- Dhaka proposes to postpone D8 Summit

Unauthorized use of news, image, information, etc published by Bangla Tribune is punishable by copyright law. Appropriate legal steps will be taken by the management against any person or body that infringes those laws.

Bangla Tribune is one of the most revered online newspapers in Bangladesh, due to its reputation of neutral coverage and incisive analysis.

F R Tower, 8/C Panthapath, Shukrabad, Dhaka-1207 | Phone: 58151324; 58151326, Fax: 58151329 | Mob: 01730794527, 01730794528