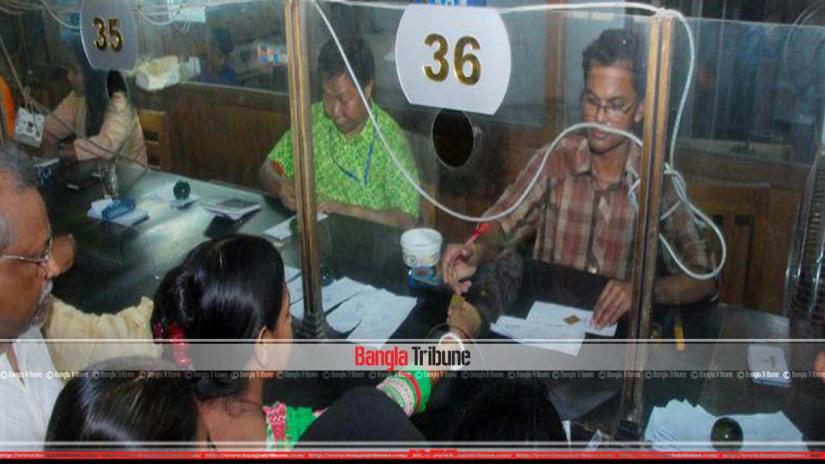

The banking profession is steadily losing appeal for the widespread arrest of officials over graft, say people familiar with the matter.

The banking profession is steadily losing appeal for the widespread arrest of officials over graft, say people familiar with the matter.

Banking officials say that the managing directors are in fear even if they’re innocent as many are being arrested without valid cause.

They say that many officials are being harassed and as a result they are losing spirit and interest their work.

Previously on Monday (Feb 25), ACC Chairman Iqbal Mahmud said during a program that at least 120 top ranking banking officials have been arrested so far.

On Mahmood’s speech, a private bank managing director, requesting anonymity told Bangla Tribune, “Many MDs who are innocent fear that they will be arrested for speaking out.”

He said that the ACC chairman’s comments were not prudent as the banking officials are continuously working hard in the interest of the country’s economy.

A former Association of Bankers’ Bangladesh (ABB) chairman is of the view that although those who are guilty must be brought to justice, the recent arrest spree of officials does not bode well for the banking sector.

“ACC can arrest whoever they see fit but they have to ensure that innocent officials don’t face harassment,” ABB Chairman and Dhaka Bank MD Syed Mahbubur Rahman told Bangla Tribune.

He said that many innocent are being punished and that is hindering the operations of the bank in addition to discouraging people to join the bank sector.

“This will lead to a scarcity of experts in the banking sector in the near future,” Rahman said.

“I’m not saying that the sector is entirely corruption free but not everyone is guilty. Only a handful is,” he added.

He said that many top ranking officials sign on many files without reading them and added, “If we read it line by line, the operations will slow down.”

Rahman said that bankers no longer sign papers like that and as a result they are losing out on prospective clients who want to take loans.

Meanwhile, a report by private research organisation Inter Press Network (IPN) said that the bankers cannot evade responsibility for the increase loan default in the banking sector.

According to IPN’s findings, many worthy clients miss out on loans while large amount of loans are approved for illegal companies.

On the other hand, a Bangladesh Bank report shows that state-owned BASIC Bank is in troubled waters for loaning out large sums to these organisations.

These ‘paper companies’ have embezzled nearly Tk 30 billion from the bank. The scenario is similar with state owned Sonali, Agrani and Janata Bank who have been cheated out of billions through these loan approvals.

The central bank Governor Fazle Kabir is of the view that not only irregularities but high expectations from loan recipients also play a part in putting the sector at risk.

He added that influential defaulters and irregularity of officers are collectively putting the economy at risk.