According to Bangladesh Bank, the amount of bad loan is Tk 826.35 billion which is 84 per cent of the defaulted loan. There’s also another Tk 350 billion delinquent loan which has been abolished. Due to a court stay order, banks are unable to recover another 1.55 trillion.

According to Bangladesh Bank, the amount of bad loan is Tk 826.35 billion which is 84 per cent of the defaulted loan. There’s also another Tk 350 billion delinquent loan which has been abolished. Due to a court stay order, banks are unable to recover another 1.55 trillion.

Another Tk 1 trillion has been rescheduled.

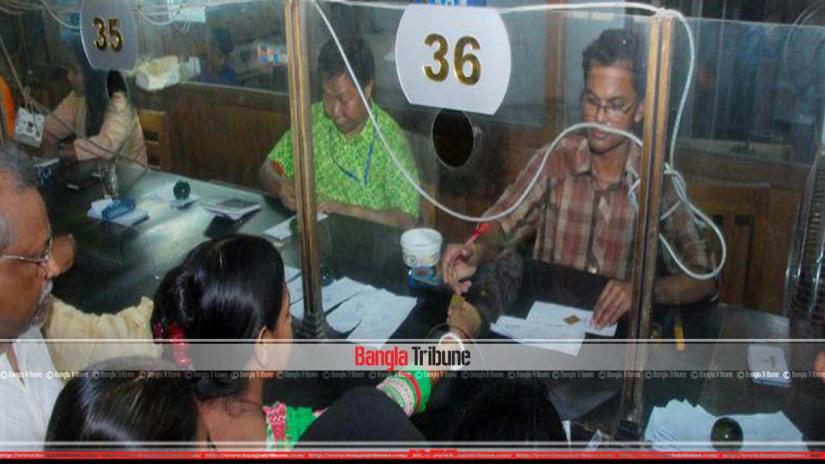

Bank officials say that though profit falls due to default loan, they cannot recover the money since many defaulters are influential people.

At the end of 2011, default loan was Tk 226.44 billion. Till September 2018, default loan stands at Tk 993.7 billion.

According to rule, banks need to keep general provision against bad loans, which is 50 per cent for suspicious loans, 20 for low amount loan and 0.5 per cent to 5 per cent for general loans.

As per central bank, 12 banks are failing to keep the security reserve against default loans due to the liquidity crisis. Of these, four are government and 8 are private sector banks.

Specialists say that due to provision deficiency, investors and shareholders are facing danger because due to the cash crunch, the banks cannot give them profit.

On 19 December, during a bankers’ meet, Governor Fazle Kabir ordered the lowering of default loan below 10 per cent.

Business

Business

41042 hour(s) 8 minute(s) ago ;

Evening 09:02 ; Sunday ; Jun 22, 2025

Banks can’t touch influential people with delinquent loans

Send

Golam Mowla

Published : 07:30, Jan 02, 2019 | Updated : 07:30, Jan 02, 2019

Published : 07:30, Jan 02, 2019 | Updated : 07:30, Jan 02, 2019

0 ...0 ...

/tf/

Topics: Top Stories

- KOICA donates medical supplies to BSMMU

- 5 more flights to take back British nationals to London

- Covid19: Rajarbagh, Mohammadpur worst affected

- Momen joins UN solidarity song over COVID-19 combat

- Covid-19: OIC to hold special meeting

- WFP begins food distribution in Cox’s Bazar

- WFP begins food distribution in Cox’s Bazar

- 290 return home to Australia

- Third charter flight for US citizens to return home

- Dhaka proposes to postpone D8 Summit

Unauthorized use of news, image, information, etc published by Bangla Tribune is punishable by copyright law. Appropriate legal steps will be taken by the management against any person or body that infringes those laws.

Bangla Tribune is one of the most revered online newspapers in Bangladesh, due to its reputation of neutral coverage and incisive analysis.

F R Tower, 8/C Panthapath, Shukrabad, Dhaka-1207 | Phone: 58151324; 58151326, Fax: 58151329 | Mob: 01730794527, 01730794528