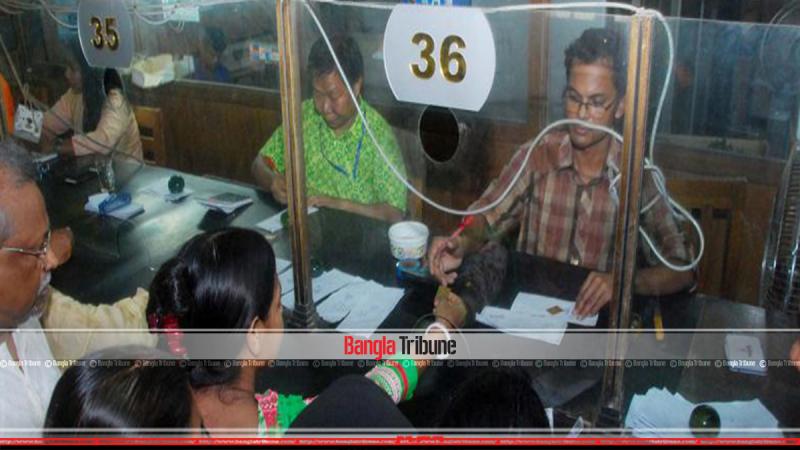

The banking sector now faces three crises; several banks face cash crunch for falling deposits as opposed to loan disbursements, scarcity of US dollar is noted with the rise in import cost and, due to lack of good governance, the entire banking sector is suffering from lack of reliability.

The banking sector now faces three crises; several banks face cash crunch for falling deposits as opposed to loan disbursements, scarcity of US dollar is noted with the rise in import cost and, due to lack of good governance, the entire banking sector is suffering from lack of reliability.

Executive director of non-government research institute, SANEM, Professor, Selim Raihan, says: “the main problem emanates from lack of reliability.”

Due to this, depositors are becoming averse towards banks, he added.

Private banks are operating according to their wishes, often flouting loan disbursement laws set by the central Bank, said Bangladesh Bank governor, Fazle Rabbi.

General people have developed a sense of distrust towards the banking sector, he added.

This is an ominous sign for the banks, he warned.

According to information of the Bangladesh Bank, since December last year to February of this year, in three months, around Tk1000 crore has been withdrawn from the banking sector.

On December, 2017, the deposit total was Tk. 9 lakh 26 thousand 179 crore which stood at Tk. 9 lakh 25 thousand 279 crore at the end of March, 2018.

President of Bangladesh Association of Banks, BAB, Nazrul Islam Mazumder, told Bangla Tribune: “due to the shambolic state of Farmers’ Bank, several government organisations withdrew money from non-government banks.”

Bankers lament that on one hand, money is not being deposited while loan disbursement is going on.

On December 2017, the excess liquidity of banks was Tk. 97,122 crore which came down to Tk. 76,888 crore at the end of March.

In three months, liquidity fell by Tk. 21 thousand crore.

Another Bangladesh Bank report states that there has been a discrepancy between import based loan growth and export plus remittance growth. As a result, the supply and demand of foreign currency was adversely impacted.

Sources say, in the last fiscal year, $ 231 crore 10 lakh was sold to local banks from the central bank reserve against Tk. 19,347 crore.

“With a rise in import, second, third and fourth generation banks are facing liquidity crisis.”

Business

Business

31055 hour(s) 41 minute(s) ago ;

Afternoon 06:35 ; Thursday ; May 02, 2024

Ominous clouds over banks

Send

Golam Mowla

Published : 04:00, Jul 20, 2018 | Updated : 04:00, Jul 20, 2018

Published : 04:00, Jul 20, 2018 | Updated : 04:00, Jul 20, 2018

0 ...0 ...

/tf/

Topics: Top Stories

- KOICA donates medical supplies to BSMMU

- 5 more flights to take back British nationals to London

- Covid19: Rajarbagh, Mohammadpur worst affected

- Momen joins UN solidarity song over COVID-19 combat

- Covid-19: OIC to hold special meeting

- WFP begins food distribution in Cox’s Bazar

- WFP begins food distribution in Cox’s Bazar

- 290 return home to Australia

- Third charter flight for US citizens to return home

- Dhaka proposes to postpone D8 Summit

Unauthorized use of news, image, information, etc published by Bangla Tribune is punishable by copyright law. Appropriate legal steps will be taken by the management against any person or body that infringes those laws.

Bangla Tribune is one of the most revered online newspapers in Bangladesh, due to its reputation of neutral coverage and incisive analysis.

F R Tower, 8/C Panthapath, Shukrabad, Dhaka-1207 | Phone: 58151324; 58151326, Fax: 58151329 | Mob: 01730794527, 01730794528