There is massive pressure on liquidity in the banking sector and to meet the demand, banks are compelled to rely on the borrowing culture.

There is massive pressure on liquidity in the banking sector and to meet the demand, banks are compelled to rely on the borrowing culture.

Banks are regularly taking loans from other banks or the central bank.

Bangladesh Bank sources say that the excess liquidity of banks has fallen by half in the last four years. A central bank report, released on Wednesday (Sept 11) also corroborates this belief.

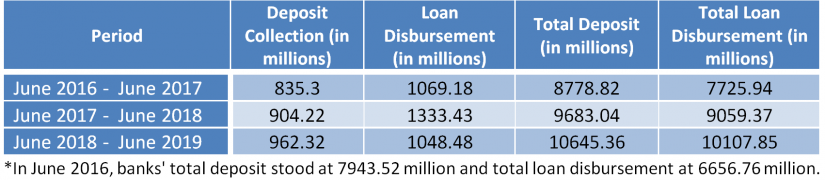

As per the report, the excess liquidity of banks at the end of June 2016, was Tk 1229.32 million and at the end of June 2019, it stood at Tk 605.49 million.

Bank officials say that due to pressure on liquidity, the interest rate is going up while private entrepreneurs are dissatisfied since they are not getting enough loans.

In last July, the loan growth in the private sector stood at 11.26 per cent, lowest since 2013.

Dhaka Bank’s MD, Syed Mahbubur Rahman, said: “Since excess liquidity has fallen, banks are under pressure and deposits are not coming as per demand. In addition, loan taking tendency of the government is increasing.”

With a dismal deposit situation, a large portion of 605.49 million is invested in low-interest bonds and bills.

As per existing rule, the mandatory deposit of banks is 18.5 per cent of the deposit, which is 11 per cent for Islami banks. Anything more than the obligatory amount is excess liquidity which is often invested in bonds.

The rest is funds for loans.

Former governor of Bangladesh Bank, Dr Salehuddin Ahmed, said: “Liquidity has fallen because loan amount did not come back and deposits have fallen.”

Bangladesh Bank says that while loans have risen in the last three years, deposits haven’t. From June 2018 till June 2019, deposit compared to loans has fallen by Tk 86.16 million.