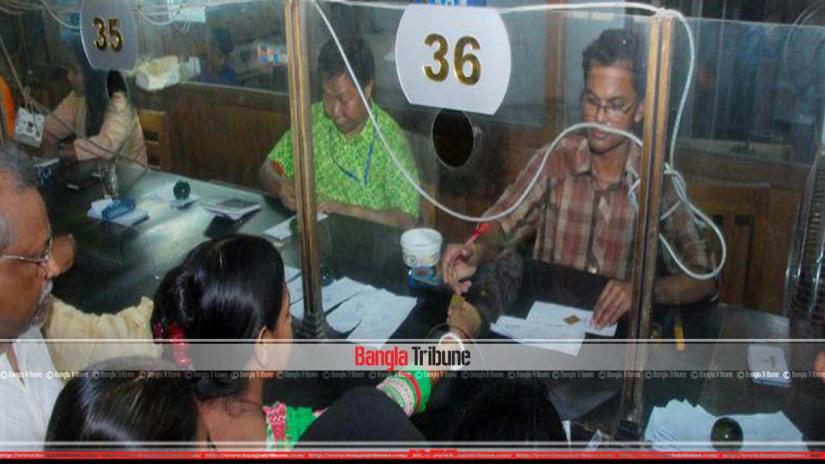

In the past, influential people used to take loans from government banks and did not return it; now, this aberration also affects private banks.

In the past, influential people used to take loans from government banks and did not return it; now, this aberration also affects private banks.

Bangladesh Bank report says that while default loan for government banks has fallen in June quarter, it has risen for private ones.

In private banks, default loan has risen by Tk. 19.74 billion. At the end of March, the default loan was Tk 499.49 billion which rose to Tk 519.24 billion.

Former governor of Bangladesh Bank, Dr Salehuddin Ahmed, said: “The sickness afflicting government banks has moved to private ones and if this goes on, then banks will need a subsidy to survive like Farmers’ Bank.”

Relevant quarters say that due to the reckless loan taking of influential people, banks are facing a liquidity crisis. Reportedly, Islami Bank is in jeopardy when millions were withdrawn from it.

After a change of ownership, Islami Bank began to show falling rates in several indicators; now it cannot give loans due to the liquidity crisis.

Till March last, the default loan of Islami Bank stood at Tk 69.16 billion which is double the amount recorded in December 2018.

From April to June this year, the default loan in the banking sector has risen by Tk 15 billion.

Bangladesh Bank says that till June this year, distributed loan stands at Tk 9627.7 billion of which default is Tk 1124.25 billion.

Business

Business

31183 hour(s) 11 minute(s) ago ;

Morning 02:06 ; Wednesday ; May 08, 2024

Loan default aberration afflicts private banks

Send

Golam Mowla

Published : 07:30, Aug 26, 2019 | Updated : 07:30, Aug 26, 2019

Published : 07:30, Aug 26, 2019 | Updated : 07:30, Aug 26, 2019

0 ...0 ...

/tf/

Topics: Top StoriesExclusive

- KOICA donates medical supplies to BSMMU

- 5 more flights to take back British nationals to London

- Covid19: Rajarbagh, Mohammadpur worst affected

- Momen joins UN solidarity song over COVID-19 combat

- Covid-19: OIC to hold special meeting

- WFP begins food distribution in Cox’s Bazar

- WFP begins food distribution in Cox’s Bazar

- 290 return home to Australia

- Third charter flight for US citizens to return home

- Dhaka proposes to postpone D8 Summit

Unauthorized use of news, image, information, etc published by Bangla Tribune is punishable by copyright law. Appropriate legal steps will be taken by the management against any person or body that infringes those laws.

Bangla Tribune is one of the most revered online newspapers in Bangladesh, due to its reputation of neutral coverage and incisive analysis.

F R Tower, 8/C Panthapath, Shukrabad, Dhaka-1207 | Phone: 58151324; 58151326, Fax: 58151329 | Mob: 01730794527, 01730794528