Bank sector specialists believe that with the lowering of interest rates over loan, banks may face an adverse impact. Bank CEO’s say that if the banks give single digit interest rates to clients, then their income will fall by 1 to 2 per cent.

Bank sector specialists believe that with the lowering of interest rates over loan, banks may face an adverse impact. Bank CEO’s say that if the banks give single digit interest rates to clients, then their income will fall by 1 to 2 per cent.

They believe that the eventual impact will be on government revenue from the banking sector which will fall by one thousand to one thousand five hundred crore.

With the lowering of corporate tax rate by 2.5 per cent, revenue to the amount of 1500 crore revenue will also fall.

Talking on the issue, chairman of Association of Bankers, ABB, and MD of Dhaka Bank, Syed Mahbubur Rahman, says: “we are reducing interest on loans but can’t reduce it for savings and deposits due to a time bound agreement; as a result our income will fall.”

Another banker says: “last month, banks imposed 11 to 12 per cent interest on some loans which have come down to 9 per cent now; obviously, banks will have to face losses.”

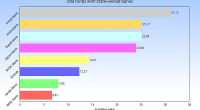

In 2018-19, Tk. 10 thousand crore has been set as a target for corporate tax. In the last fiscal year, this was Tk. 7.5 thousand crore.

Economists believe that this year, government’s revenue from banking sector will fall by three thousand crore.

Executive director of non-government research centre, SANEM, Professor Selim Raihan, told Bangla Tribune: “the sudden fall in interest rate will have long term repercussions with a dip in revenue earnings.”

Of the corporate tax, 70 per cent comes from banking, giving it a place among the top ten Large Tax Units, LTU.

The decision to reduce interest rate is supposed to be implemented from 1 July.

Meanwhile, the unaudited financial report of banks for the period (Jan-March) shows that during this time frame in 2018, the net profit was lower than the same period last year.

Though in the first six months of 2018, the operation profit of banks has risen. In 2017, the operation profit of banks was Tk. 24 thousand 647 crore, which was Tk. 21 thousand 567 crore.

Business

Business

41359 hour(s) 59 minute(s) ago ;

Morning 02:54 ; Sunday ; Jul 06, 2025

Banks edgy over lowering interest rates: national revenue may fall

Send

Golam Mowla

Published : 15:16, Jul 08, 2018 | Updated : 15:20, Jul 08, 2018

Published : 15:16, Jul 08, 2018 | Updated : 15:20, Jul 08, 2018

0 ...0 ...

/tf/up-pdn/

Topics: Top Stories

- KOICA donates medical supplies to BSMMU

- 5 more flights to take back British nationals to London

- Covid19: Rajarbagh, Mohammadpur worst affected

- Momen joins UN solidarity song over COVID-19 combat

- Covid-19: OIC to hold special meeting

- WFP begins food distribution in Cox’s Bazar

- WFP begins food distribution in Cox’s Bazar

- 290 return home to Australia

- Third charter flight for US citizens to return home

- Dhaka proposes to postpone D8 Summit

Unauthorized use of news, image, information, etc published by Bangla Tribune is punishable by copyright law. Appropriate legal steps will be taken by the management against any person or body that infringes those laws.

Bangla Tribune is one of the most revered online newspapers in Bangladesh, due to its reputation of neutral coverage and incisive analysis.

F R Tower, 8/C Panthapath, Shukrabad, Dhaka-1207 | Phone: 58151324; 58151326, Fax: 58151329 | Mob: 01730794527, 01730794528