With an eye of implementing the Awami League’s electoral pledges, Finance Minister AHM Mustafa Kamal has unveiled a Tk 5.23 trillion proposed nation budget for FY20 in Parliament on Thursday (Jun 13).

With an eye of implementing the Awami League’s electoral pledges, Finance Minister AHM Mustafa Kamal has unveiled a Tk 5.23 trillion proposed nation budget for FY20 in Parliament on Thursday (Jun 13).

“We are committed to the nation to realise fully the Vision 2021 and implement the agenda for 2030 for building a happy and prosperous future for the nation, and thus materialize the Father of the Nation’s cherished dream of establishing Sonar Bangla (Golden Bengal), which is the fundamental premise of our current election manifesto too,” he said in budget.

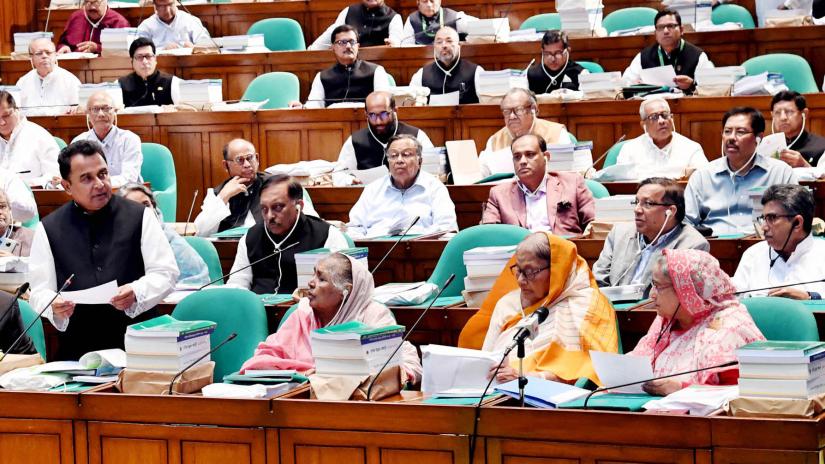

Kamal started to present his 128-page budget speech styled ‘Bangladesh on a Pathway to Prosperity: Time is Ours, Time for Bangladesh’ but fumbled through the start before being allowed by Speaker Shirin Sharmin Chaudhury to deliver his address sitting down.

But he continued to struggle throughout the session when Prime Minister Sheikh Hasina took over from him to complete the address in a rare and novel move.

In his maiden budget, Kamal proposed to implement the new VAT law from the first day of the new fiscal, a number of welfare oriented initiatives and reforms in the banking sector, capital market, savings certificates and social safety net programmes, generate employments and enrolment of educational institutions under the MPO system.

The size of the budget is Taka 586.17 billion higher than the last fiscal presented by his predecessor Abul Maal Abdul Muhith.

Muhith last year presented a Tk 4.64 trillion budget before he went on retirement by serving as the first finance minister in Bangladesh to present the budget for a consecutive 10 times since 2009.

“As a sequel of the Vision 2021, the present government brings before the nation a new Perspective Plan ‘Vision 2041’. We are determined to elevate Bangladesh from the status of a middle income country, and become a peaceful, happy and prosperous developed country by 2041,” Finance Minister Kamal said in his budget speech.

The proposed budget aims to achieve 8.2 percent GDP growth while reining in the rate of inflation to 5.5 percent.

Regarding the implementation of the long-awaited Value Added Tax Act, 2012 from the coming fiscal year (2019-20), Kamal said the government would provide all types of logistical support including necessary manpower in this regard.

The proposed budget sets out a revenue income goal of Tk 3.77 trillion, marking an increase of 19 percent from the revised budget of the current fiscal year.

Out of this, Tk 3.25 trillion will be collected through the National Board of Revenue. Tax revenue from non-NBR sources have been estimated at Tk. 145 billion. Besides, non-tax revenue is estimated at Tk. 377.10 billion.

Finance Minister Kamal said the size of Tk 5.23 trillion budget is 18.1 percent of GDP.

“Total allocation for operating and other expenditures is Taka 3.20 trillion, and allocation for the annual development program is Tk 2.02 trillion.”

The overall deficit stands at Tk 1.45 trillion, which amounts to five percent of the GDP.

Kamal plans to rake in Tk 680.16 billion from external sources and Tk 773.63 billion from domestic sources to balance the deficit.

The budget proposes to borrow Tk 743.64 billion from the banking system while another Tk 300 billion from other sources like, savings schemes.

Kamal in his budget speech said the government is aiming to achieve the double digit growth as quickly as possible through timely implementation of all nationally important infrastructure projects including mega projects.

He said the government would need a huge amount of financial resources till 2030 to implement SDGs where the role of the private sector, in addition to the government, will be crucial to meet this resource gap.

To revitalise the capital market, he said special incentives would continue for encouraging investment in stocks.

In order to save the farmers from the financial loss caused by this, a pilot project for ‘crop insurance’ will be introduced. In addition, insurance of properties generated from large projects will be covered by the local insurance companies.

“As per our Election Manifesto, 2018,” he said, “the budget allocation in the social safety net sector will be doubled in the next five years.”

The government has allocated Taka 743.67 billion in the sector, which is 14.21 percent of total budget and 2.58 percent of GDP in FY20.

Since the government pensioners are only a small fraction of the total population in the country, Kamal proposed forming a ‘Universal Pension Authority’ for gradual introduction of the pensions for everyone in formal and informal sectors of the economy.

About the tax-free income tax ceiling, he said the criteria for keeping the threshold unchanged for the last few years have remained the same this year as well.

Mentioning that all eligible taxpayers would be brought under the tax net, he said the number of taxpayers would be raised to 10 million at the earliest possible time.

Kamal said the government would establish revenue offices in every Upazila and Growth Center in the country and those would have necessary manpower and other logistics to facilitate revenue collection.

“I would like to inform the august House that we have not included any component in the budget of FY2019-20 that may cause a price spiral for essential commodities,” he added.

National

National

41319 hour(s) 8 minute(s) ago ;

Morning 10:03 ; Friday ; Jul 04, 2025

Bangladesh rolls out Tk 5.23tr budget for FY20

Send

Bangla Tribune Report

Published : 22:42, Jun 13, 2019 | Updated : 23:45, Jun 13, 2019

Published : 22:42, Jun 13, 2019 | Updated : 23:45, Jun 13, 2019

0 ...0 ...

/zmi/

Topics: Top Stories

- KOICA donates medical supplies to BSMMU

- 5 more flights to take back British nationals to London

- Covid19: Rajarbagh, Mohammadpur worst affected

- Momen joins UN solidarity song over COVID-19 combat

- Covid-19: OIC to hold special meeting

- WFP begins food distribution in Cox’s Bazar

- WFP begins food distribution in Cox’s Bazar

- 290 return home to Australia

- Third charter flight for US citizens to return home

- Dhaka proposes to postpone D8 Summit

Unauthorized use of news, image, information, etc published by Bangla Tribune is punishable by copyright law. Appropriate legal steps will be taken by the management against any person or body that infringes those laws.

Bangla Tribune is one of the most revered online newspapers in Bangladesh, due to its reputation of neutral coverage and incisive analysis.

F R Tower, 8/C Panthapath, Shukrabad, Dhaka-1207 | Phone: 58151324; 58151326, Fax: 58151329 | Mob: 01730794527, 01730794528