Asian Development Bank (ADB) will provide a second tranche loan of US$170 million to conclude the third capital market development programme (CMDP) in Bangladesh, reports BSS.

Asian Development Bank (ADB) will provide a second tranche loan of US$170 million to conclude the third capital market development programme (CMDP) in Bangladesh, reports BSS.

“ADB’s long-term engagement through its CMDP has transformed legal, regulatory and institutional market frameworks in line with government’s development priority to mobilize long-term financing for productive investments, such as infrastructure and sustained economic growth toward middle-income status,” said ADB Financial Sector Specialist Takuya Hoshino.

ADB approved the programme totalling US$250 million in November 2015 with a first tranche US$80 million loan to support vital capital market reforms accompanied by a technical assistance grant of US$700,000, out of which US$300,000 was financed by Korea’s e-Asia and Knowledge Partnership Fund to assist implementation of the reform actions, said ADP press release received in Dhaka on Saturday (Feb 15).

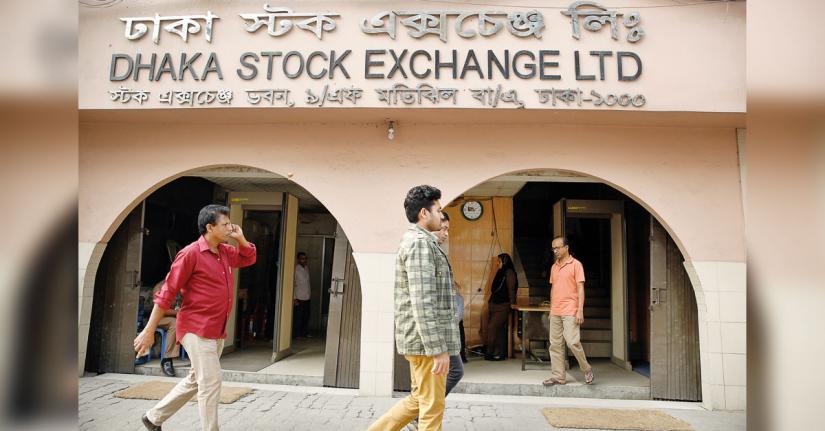

ADB has been actively supporting government’s current capital market reform agenda since 2012 when the second CMDP was approved. It is aimed to rebuild market confidence after stock market turbulence in December 2010 and put the capital market back onto a sustainable development path. The programme resulted in the 10-year national capital market development master plan and critical legislations for ensuring the independence of the Bangladesh Securities Exchange Commission (BSEC) as a regulator, demutualizing the two stock exchanges, better corporate governance, more reliable financial reporting and auditing, and insurance sector development.

The programme resulted in the 10-year national capital market development master plan and critical legislations for ensuring the independence of the Bangladesh Securities Exchange Commission (BSEC) as a regulator, demutualizing the two stock exchanges, better corporate governance, more reliable financial reporting and auditing, and insurance sector development.

The third CMDP was introduced in 2015 to build on the foundation established under the second programme to broaden and deepen the reach of the reforms and overcome remaining constraints in sustainable market development.

It focused on the actual implementation of regulatory and institutional reforms, such as for strengthening regulatory and supervisory capacity of BSEC, establishing a risk-based capital framework for market intermediaries, enhancing the clearing and settlement system, introducing new financial instruments by the two demutualized stock exchanges, establishing a Financial Reporting Council and strengthening governance of the insurance sector.

Business

Business

30755 hour(s) 55 minute(s) ago ;

Morning 06:49 ; Saturday ; Apr 20, 2024

$170m ADB loan for capital market reforms

Send

Bangla Tribune Desk

Published : 07:30, Feb 16, 2020 | Updated : 07:30, Feb 16, 2020

Published : 07:30, Feb 16, 2020 | Updated : 07:30, Feb 16, 2020

0 ...0 ...

/hb/

Topics: Top Stories

- KOICA donates medical supplies to BSMMU

- 5 more flights to take back British nationals to London

- Covid19: Rajarbagh, Mohammadpur worst affected

- Momen joins UN solidarity song over COVID-19 combat

- Covid-19: OIC to hold special meeting

- WFP begins food distribution in Cox’s Bazar

- WFP begins food distribution in Cox’s Bazar

- 290 return home to Australia

- Third charter flight for US citizens to return home

- Dhaka proposes to postpone D8 Summit

Unauthorized use of news, image, information, etc published by Bangla Tribune is punishable by copyright law. Appropriate legal steps will be taken by the management against any person or body that infringes those laws.

Bangla Tribune is one of the most revered online newspapers in Bangladesh, due to its reputation of neutral coverage and incisive analysis.

F R Tower, 8/C Panthapath, Shukrabad, Dhaka-1207 | Phone: 58151324; 58151326, Fax: 58151329 | Mob: 01730794527, 01730794528