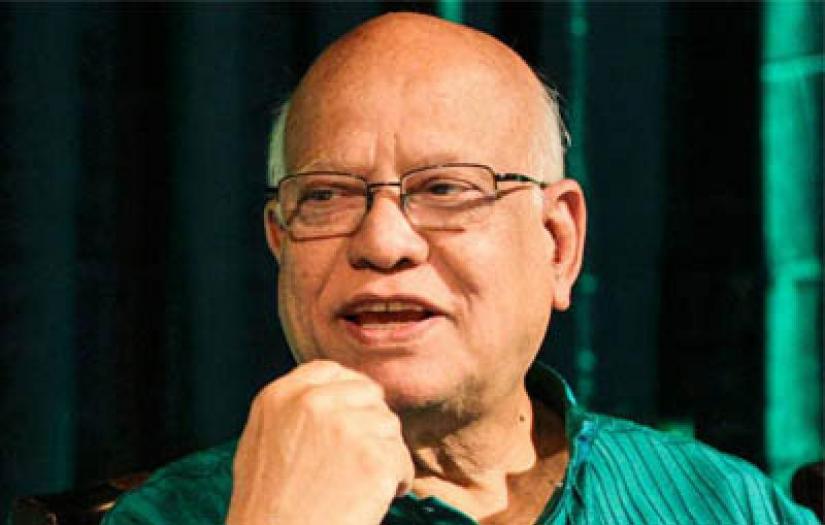

Former finance minister AMA Muhith has been exempted from paying tax on an imported car by the tax regulation body.

Former finance minister AMA Muhith has been exempted from paying tax on an imported car by the tax regulation body.

The National Board of Revenue issues a special order on Monday (Aug 17) stating that the former lawmaker has been given a tax exemption on his imported Toyota Land Cruiser.

The NBR order said that Muhith served as a minister during the 10th Parliament but didn’t contests in 11th national polls.

“Even though he isn’t entitled to tax-free import of cars, the authorities have exempted him from paying tax on his car taking current circumstances into consideration,” it said.

The NBR said that Muhith has been granted the exemption under Section 20 of The Customs Act, 1996 and Section 126 (1) of The Value Added Tax and Supplementary Duty Act, 2012.

Section 20 of The Customs Act, 1996 says, “If the [Government] is satisfied that it is necessary in the public interest to do so, it may, under circumstances of exceptional nature,] subject to such conditions, limitations or restrictions, if any, as it thinks fit to impose, by a special order in each case recording such circumstances, exempt any goods from payment of the whole or any part of the customs-duties chargeable thereon.”

Meanwhile, Section 126 (1) of The Value Added Tax and Supplementary Duty Act, 2012 says, “The Government may, by a notification in the official Gazette, exempt, the whole or a part of the taxes imposable under this Act, if a need arises to take immediate action to face a situation of national importance, for a specified period till the next Finance Act takes effect, but if the exemption given under this sub-section is not included in the next Finance Act, it shall automatically become ineffective.”

The tax regulation body, however, has imposed three conditions for the exemption:

1. The imported car cannot be sold or handed over to someone else within the next five years. However, if it is sold before that time period, all the taxes must be paid to the tax commissioner.

2. An NBR clearance is mandatory prior to the car being sold or handed over to someone else.

3. In case of the owner dying within the next five years, his heirs will not be required to pay any taxes. However, if the car’s ownership is passed onto anyone other than the heir, all the taxes must be paid to the tax commissioner.

Responding to queries on the matter, NBR Chairman Mosharraf Hossain Bhuiyan said that Muhith had already applied for a tax exemption.

“He is being given this privilege based on that application. Besides, he didn’t avail the tax-exemption privilege during his last term as minister,” he added.

Muhith didn’t receive the call when Bangla Tribune tried to reach him for comments.