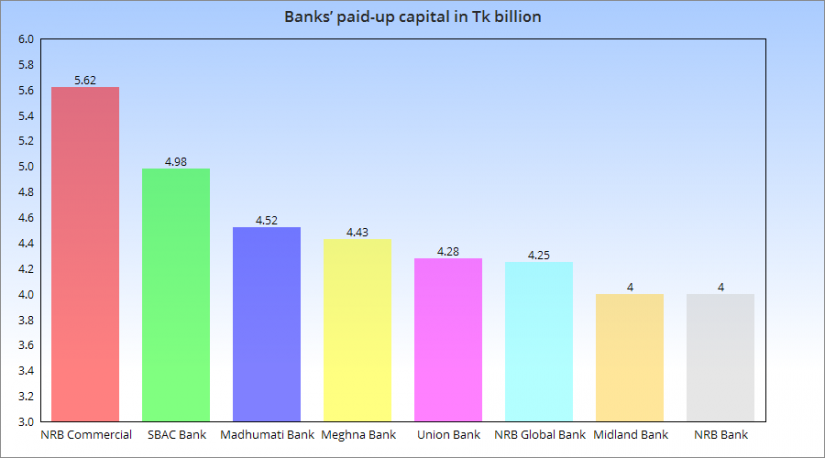

Banks are concerned over the central bank’s decision to raise the paid-up capital to Tk 5 billion.

Banks are concerned over the central bank’s decision to raise the paid-up capital to Tk 5 billion.

Recently three banks - Bengal Commercial Bank, The Citizen’s Bank and People’s Bank got the green light to start operations. They got permission on the condition to pay Tk 5 billion as paid-up capital.

In addition to approving the banks on Sunday (Feb 17), Bangladesh Bank also made a few important decisions regarding the paid-up capitals of the already operating banks.

The banks which got started operations in 2013 were required to pull up paid-up capitals of Tk 4 billion but the amount may go up.

Central bank officials said that the 14 private banks approved over the last seven years might have to pull up paid-up capital of Tk 5 billion.

A new generation bank managing director wishing to remain anonymous said that his bank is struggling with the current paid-up capital.

They will face pressure if they are required to pull up another 1 billion paid-up capital, said the top official adding, “Because, entrepreneurs want more return than the amount they invest in banks. ”

“It’s good for the overall banking sector if the previously operating banks feel the pressure,” BB Executive Director Abu Farah Md Naser told Bangla Tribune.

“Even banking entrepreneurs are saying that the financial sector is expanding and they want more banks,” he added. Naser commented that paid-up capital of Tk 5 billion shouldn’t be a big deal and added, “The central bank has decided to increase the paid-up capital to keep the depositors’ investments risk-free.”

Naser commented that paid-up capital of Tk 5 billion shouldn’t be a big deal and added, “The central bank has decided to increase the paid-up capital to keep the depositors’ investments risk-free.”

Meanwhile, Padma Bank, formerly known as Farmers Bank Managing Director Ehsan Khasru says that he won’t have a problem with the Tk 5-billion benchmark as their current paid-up amount is Tk 11.16 billion.

Many banks including Farmers Bank which started operating in 2013 have fallen at risk due to irregularity and graft. As a result, the central bank took many initiatives to assist the banks in getting out of the mess.

In order to resolve the Farmers Bank crisis, the central bank arranged for the four state-owned banks (Sonali, Janata, Agrani and Rupali) and ICB to provide the necessary paid-up capital.

The central bank will soon order the paid-up capitals to be equalized for all banks in order to improve the banking sector.

Business

Business

30878 hour(s) 42 minute(s) ago ;

Morning 09:36 ; Thursday ; Apr 25, 2024

Banks concerned over BB’s move to raise paid-up capital

Send

Golam Mowla

Published : 07:30, Feb 23, 2019 | Updated : 07:30, Feb 23, 2019

Published : 07:30, Feb 23, 2019 | Updated : 07:30, Feb 23, 2019

0 ...0 ...

/st/

Topics: Top Stories

- KOICA donates medical supplies to BSMMU

- 5 more flights to take back British nationals to London

- Covid19: Rajarbagh, Mohammadpur worst affected

- Momen joins UN solidarity song over COVID-19 combat

- Covid-19: OIC to hold special meeting

- WFP begins food distribution in Cox’s Bazar

- WFP begins food distribution in Cox’s Bazar

- 290 return home to Australia

- Third charter flight for US citizens to return home

- Dhaka proposes to postpone D8 Summit

Unauthorized use of news, image, information, etc published by Bangla Tribune is punishable by copyright law. Appropriate legal steps will be taken by the management against any person or body that infringes those laws.

Bangla Tribune is one of the most revered online newspapers in Bangladesh, due to its reputation of neutral coverage and incisive analysis.

F R Tower, 8/C Panthapath, Shukrabad, Dhaka-1207 | Phone: 58151324; 58151326, Fax: 58151329 | Mob: 01730794527, 01730794528