The government is gearing up to make income tax certificate and National ID mandatory for investing in government-offered savings schemes in a bid to stamp out illegal money.

The government is gearing up to make income tax certificate and National ID mandatory for investing in government-offered savings schemes in a bid to stamp out illegal money.

The Directorate of National Savings (DNS) will soon sign agreements with the Election Commission and National Board of Revenue (NBR) on the issue.

“We have reached out to NBR to incorporate TINs (tax identification number) in savings certificate,” DNS Director General Shamsunnahar Begum told Bangla Tribune.

Previously, during the meeting of a government panel of debt management, it was decided that tax certificates and NIDs will be made compulsory for the buyers.

The DNS has no database on the buyers. “We have no information on buyers. Any Bangladeshi citizen, over 18 years old, can buy saving certificates now,” Begum said.

However, since a database is being created, it will now be possible to link the TIN to it.

Analysts say the disparity between the interest in bank deposit and savings certificate has encouraged a large number of people to buy savings certificates by the Directorate of National Savings (DNS).

Commercial banks are offering a maximum 6 percent interest against fixed capital against the over 11 percent offered by the DNS schemes.

The interest on five-year family savings certificates on maturity is 11.52%. The rate is 11.76% for five-year pensioner savings certificates, 11.28% for five-year Bangladesh savings certificates, 11.04% for three-year savings certificates paying quarterly profits and 11.28% on three-year post office savings certificates.

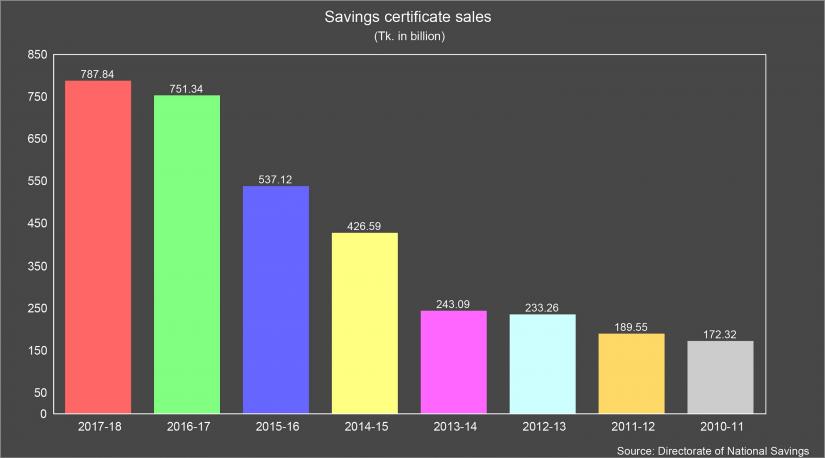

The government borrowing from savings certificates has been exceeding its target for the last few years.

Savings certificates are considered a form of loan for the government because it has to pay monthly interest to savings certificate holders.

A volatile capital market and fall in banking interest have encouraged people to invest in the savings certificates. Moreover, no questions are asked over the source of the funds.

Bangladesh Bank says that the high-interest rate has led some banks and financial institutions to invest in the government-offered schemes.

The saving-schemes were originally aimed at fixed-income group and pensioners. But analysts believe the high-income group accounts for nearly for 90 percent of the buyers.

“In reality, high-level government officials, high-income group and politicians accounts for 90 percent,” Ahsan H Mansur of the Policy Research Institute told Bangla Tribune.

“In reality, high-level government officials, high-income group and politicians accounts for 90 percent,” Ahsan H Mansur of the Policy Research Institute told Bangla Tribune.

According to the executive director of the private think-tank, 85 percent of the saving certificates are being held by 12 percent of the buyers, while the rest 88 percent buyers have the 15 percent.

“A large sum of black money is being used to buy savings certificates.”

In the first five months of the 2018-19 fiscal year (July-November) Tk 216.62 billion worth of savings certificates which is already 82.69 percent of the yearly target.

The government has fixed the target of selling Tk 261.97 billion worth savings certificates.

Savings certificates worth over Tk 800 billion were sold in the just concluded 2017-18 fiscal.

According to the Bangladesh Bank, nearly 20 million people have invested in the saving schemes.